In wake of the new lease accounting standards, Accounting Standards Codification (ASC) 842 and International Financial Report Standards (IFRS) 16, it’s important that you have the right technology in place to handle complicated lease situations and ensure that your organization is compliant.

Many companies without a comprehensive lease management software rely on tedious manual processes, spreadsheets and disparate systems that are cumbersome and prone to errors. Thankfully, there are lease management solutions that can stand alone or seamlessly integrate with ERP systems to consolidate data, reduce inaccuracies and streamline everyday operations.

Let’s review the ASC 842 and IFRS 16 lease accounting requirements and examine what to look for in a lease management solution, including examples of add-ons in NetSuite and Microsoft Dynamics 365 Business Central to achieve compliance and transform your current processes.

Compliance and the Demand for a Lease Accounting Solution

Lease accounting rules drastically changed with the introduction of ASC 842 and IFRS 16. The two standards have some differences, but both aim to improve the transparency in reporting on leases, adjusting the definition of a lease, differentiating between lease types and establishing global accounting uniformity.

Complying with ASC 842 and IFRS 16 requires more than capturing data in a consolidated system. For organizations affected by the two new standards, the ability to eliminate manual processing becomes exponentially more beneficial with each lease contract they sign, and having an accounting system with the ability to handle this becomes a necessity.

Let’s look at the details of ASC 842 and IFRS 16 to better understand the need for a lease management solution.

ASC 842 Compliance

Lessees are more likely to be affected by the new Financial Accounting Standards Board (FASB) lease accounting standard, ASC 842. While ASC 842 keeps the two-model approach to classifying leases as operating or finance, most leases must now be recorded on the balance sheet as a Right of Use (RoU) asset with a corresponding liability. This wasn’t the case for operating leases under previous regulations.

While the impact is much greater for lessees, ASC 842 also affects lessors managing their disclosures and financial statements. The new standard’s profit recognition requirements are consistent with those mandated by FASB’s requirements and the definition of a lease is now the same for both lessors and lessees.

IFRS 16 Compliance

IFRS 16 is the new international financial reporting standard specific to lease accounting mandated by the International Accounting Standards Board (IASB). While ASC 842 categorizes leases as either operating leases or finance leases, all leases under IFRS 16 are required to be handled as finance leases.

IFRS 16 permits lessees to apply a recognition exemption for leases of less valuable assets (ones with a value lower than or equal to $5,000 when new). If lessees choose to recognize a lease, they can only apply a single accounting model on their balance sheet.

Under IFRS 16, lessees are required to recognize whether a contract is a lease or contains lease components at its inception, similar to ASC 842’s requirement. While this is straightforward in many cases, it may require lessee entities to devote more time and effort to their lease definition process or improve in-house accounting software to bolster their compliance efforts. Enter the need for an extensive lease management solution.

Features to Look for In Lease Accounting Software

After confirming the lease management solution you’re considering is compliant with ASC 842 and IFRS 16 accounting requirements for lessees and lessors, verify that it has the following features:

1. Flexible Lease Administration

The system should automate your processes and allow you to easily set up and manage lease terms and renewals.

2. Manage Charges With Accuracy

Processing complex charges and properly allocating them is the most common point of error when managing multiple leases or relying on manual processes. A lease management solution makes managing charges less complicated and more accurate while enabling your organization’s compliance.

3. Detailed Reporting

You need access to accurate reporting to make the right decisions. Get detailed information with a system that tracks your lease-related data in real-time and provides custom reporting.

4. Ease of Implementation

A lease management solution should easily integrate with your ERP system to align with and improve your business processes.

Examples of Lease Management Solutions

There are lease management add-ons specifically designed to integrate with certain ERP systems. If you use Business Central or NetSuite, one of the following solutions may be a good fit for you.

NetLease, described below as an add-on to NetSuite, can also be used by organizations that use a different software solution.

Binary Stream’s Property Lease Management In Business Central

If you’re a Business Central user, Binary Stream’s Property Lease Management (PLM) system is directly embedded in Business Central to centralize lease data from disparate systems. PLM streamlines managing multiple leases, subleases and complex contracts by automating lease creation and eliminating the potential for human error and repetitive tasks.

It houses the necessary tools to manage your properties while complying with ASC 842 and IFRS 16 and simplifies lessor and lessee accounting processes. Powered by its robust automation engine, PLM manages lease liabilities, right-of-use assets and individual contracts with both lease and non-lease components. Complying with recent accounting standards is much more attainable once you digitize your lease portfolio and centralize data.

Aside from the lease processing and administration, PLM builds detailed vacancy and delinquency reports, rent roll reports and lease summary reports to improve your analysis and forecasting for better business decisions.

NetLease: Lease Accounting In NetSuite

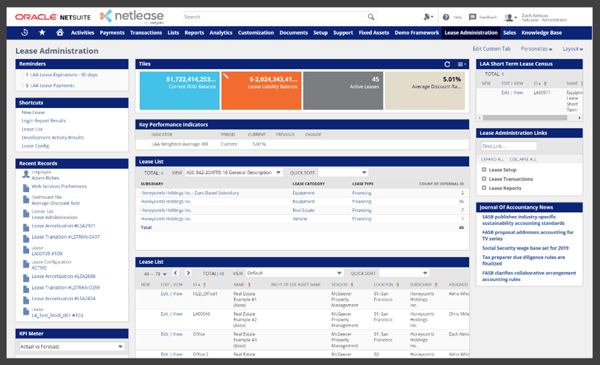

Netgain’s NetLease is a lease accounting solution built for NetSuite, so you can use it directly in your NetSuite account to manage, administer and comply with ASC 842 and IFRS 16.

NetLease will manage the complete lease lifecycle for your organization. The NetLease dashboard gives you real-time visibility and full lease automation, including integrated accounts payable management, push-button reporting for FASB and IFRS disclosures, robust end-to-end audit trails and more.

NetLease dashboard

You’ll be able to adhere to FASB ASC 842 and IFRS 16 requirements throughout conversion, implementation, reporting and ongoing lease management.

Key Takeaways

To comply with the IFRS 16 and ASC 842 leasing standards, carefully choose the right lease accounting solution for your organization. Make sure that whatever system you choose is compliant, in alignment with your ERP system for a smooth integration and has the necessary features to serve its purpose — to improve and simplify your lease accounting processes and achieve compliance.

Need Help?

For help finding the right lease management solution for your organization, connect with us here or call 410.685.5512.

![[TSG] 11-9-22 ERP webinar recording image](https://www.gma-cpa.com/hs-fs/hubfs/TSG%20Events%20-%202022/11-9-22%20ERP%20Webinar/%5BTSG%5D%2011-9-22%20ERP%20webinar%20recording%20image.png?width=400&height=400&name=%5BTSG%5D%2011-9-22%20ERP%20webinar%20recording%20image.png)