It’s unfortunate when government contractors lose revenue and profits because they lack controls, policies and processes for submitting allowable cost claims. Adding 10% or more to your top line could be as simple as doing more training or more review of expenses.

While many government contractors are in this boat, it’s a very fixable problem.

6 Policies Your Business Should Have Regarding Allowable Costs

In order to consistently recover allowable costs with minimal hassles, your government contracting business should have a set of allowable cost policies that include:

-

Proper structure for a chart of accounts

-

Documentation and ongoing training for all staff to enable them to distinguish between allowable and unallowable costs

-

Processes and procedures for using the firm’s electronic expense reporting system in order to map expenses to proper accounts

-

Documentation and ongoing training for all staff on the documentation required when submitting a claim for allowable expenses

-

Procedures for regular and periodic review of expense submission data entry, as well as aggregated expense reports

-

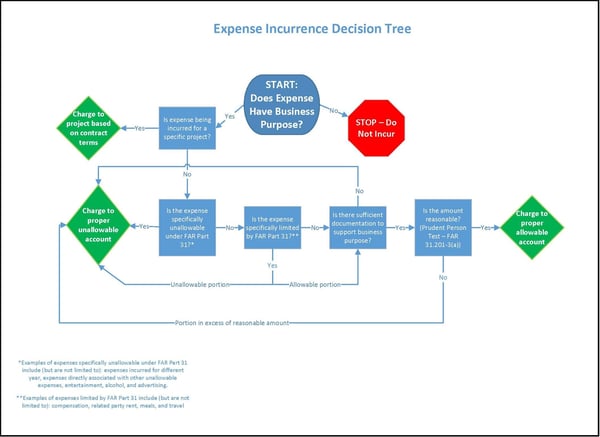

A “decision tree” that can help employees decide how an expense should be charged

Example of a decision tree for handling expenses

Your Accounting Firm Can Help You with Allowable Cost Policies

If you think your business might be leaking revenue and profit because too many costs are being disallowed, when they could have been allowable with the proper support, turn to your CPA firm for help.

They’ll analyze what you have in place, evaluate internal controls, identify gaps in policies, and make recommendations on how to plug those holes. Many CPA firms also have experience in training staff on integrating new policies into their daily schedule.

It just makes all the sense in the world to keep money in your pockets — especially if it only requires a few tweaks and a few new ways to turn the disallowed into allowable.

Need Help?

If you have questions or want guidance on how to avoid unallowable costs, we can help. Known for our expertise in conducting overhead audits, our Government Contracting Group works closely with construction contractors, architects, engineers and other government contractors to help them understand how overhead rates work and how to maximize compensation.

Contact us online or call 800.899.4623.