As we near the end of 2023, individuals may be surprised to learn of substantial tax provision changes sitting on the horizon. The tax provisions enacted in 2017 as part of the Tax Cuts and Jobs Act (TCJA) are sunsetting with the end of the 2025 tax year.

Since January 1, 2026, is just around the corner, we want to make you aware of the various provisions to ensure you are ready for what’s coming down the pike.

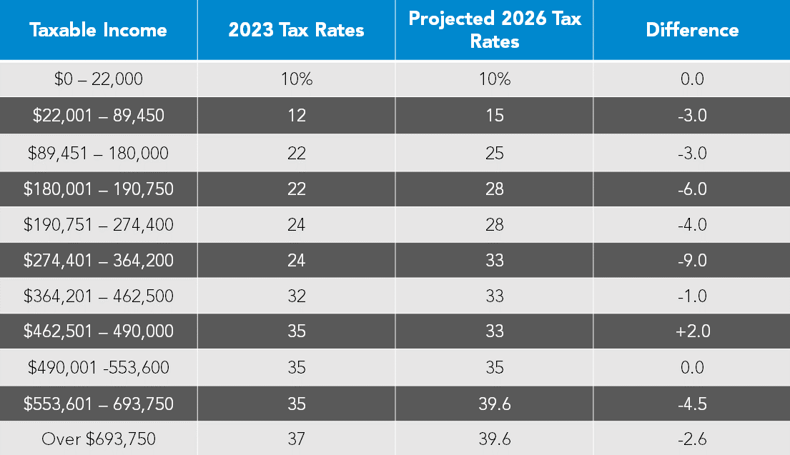

Tax Rate Changes for "Married Filing Joint" Couples

Starting January 1, 2026, tax rates will revert to their 2017 levels before TCJA was enacted. This chart compares 2023 tax rates versus projected 2026 tax rates for married couples filing jointly.

Standard Deduction and Exemptions

When it comes to the standard deduction, it will be cut approximately in half. For reference, the 2023 standard deduction amounts are:

-

$13,850 for single/married filing separate (2026: $6,952)

- $20,800 for head of household (2026: $10,400)

-

$27,700 for married filing jointly (2026: $13,850)

Personal exemptions will return and are $4,050 per taxpayer/dependent and are subject to phase-out limitations.

Child Tax Credit

The child tax credit, created to help families with qualifying children reduce their taxable income, will be reduced from its current $2,000 per qualifying child to $1,000 per qualifying child beginning January 1, 2026. The child tax credit is subject to income limitations.

Qualified Business Income Deduction

The current 20% deduction for qualified business income is going to be eliminated. As a result, any S corporation business might be incentivized to convert to a C corporation since the income tax rates for C corporations will remain the same — a flat rate of 21%.

Itemized Deductions

Multiple changes to itemized deductions will occur as they revert to their original 2017 levels:

-

The state and local tax (SALT) cap of $10,000 for itemized deductions will expire at the end of 2025.

-

Right now, the mortgage interest deduction is limited to interest paid on $750,000 of qualified debt. But starting January 1, 2026, the mortgage interest deduction will be limited to interest paid on $1,000,000 of qualified debt and $100,000 of qualified home equity interest debt. Interest paid on qualifying debt exceeding these limits are phased out gradually.

-

Miscellaneous deductions that exceed 2% of adjusted gross income (AGI), which are currently not deductible, will be deductible beginning January 1, 2026. Deductions for these include investment fees, tax preparation fees, unreimbursed work-related expenses and more.

Bonus Depreciation

Bonus depreciation, which previously allowed for the accelerated depreciation of assets placed in service, has already begun to be phased out. As of right now, bonus depreciation is limited to 80% of the purchase price of the asset. For each year moving forward, the amount of bonus depreciation that can be deducted is reduced by 20% until it reaches 0% beginning January 1, 2027.

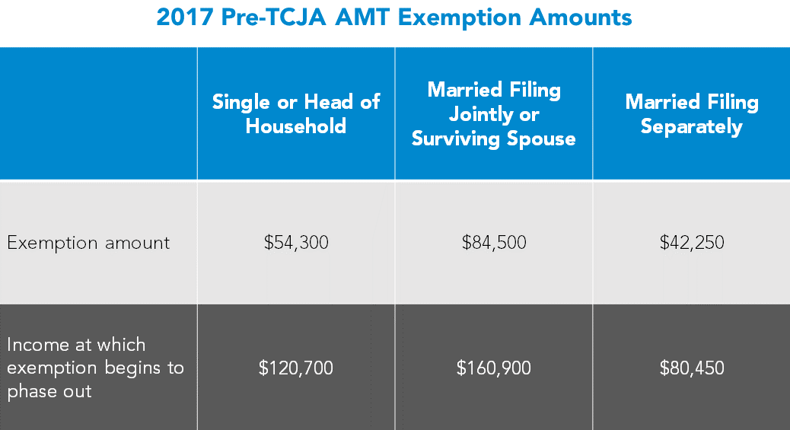

Alternative Minimum Tax

As stated by the IRS, “Under the tax law, certain tax benefits can significantly reduce a taxpayer’s regular amount.” Alternative minimum tax (AMT) is for taxpayers who earn a significant amount of income, as it sets limits on any tax breaks they might receive.

AMT exemption amounts and income phase-outs were drastically raised when TCJA was enacted, but in 2026, the AMT exemption and income amounts will revert to pre-TCJA levels. We do not yet have 2026 amounts, but below is a comparison of the 2023 and 2017 AMT exemption and income amounts.

Estate and Gift Tax

In 2017, TCJA nearly doubled the lifetime estate and gift tax exemption from $5.6 million to $11.18 million for individuals. As of 2023, the amount has been indexed for inflation and is $12.92 million for individuals and $25.84 million for married couples. With the sunsetting of TCJA, the inflation adjusted amount of the exemption is expected to reduce to approximately $7 million for individuals and $14 million for married couples. These exemptions will be reduced by almost half, and as a result, individuals and families should evaluate their estate plans to explore whether it is more advantageous to effectively exhaust the larger exemption before it is gone.

Need Help?

There’s no better time than now to find out exactly how the sunset of TCJA impacts you and your tax situation. Contact us here or call 800.899.4623 to learn how you can take advantage of any new tax savings opportunities.

.png?width=338&height=400&name=Estate%20Planning%20Checklist%20mockup%20image%20(500px).png)