The like-kind exchange is one of the most money-savvy ways to defer capital gains taxes while building your long-term wealth.

A 1031 exchange, which gets its name from Section 1031 of the Internal Revenue Code, can help you swap one investment property for another and defer capital gains taxes. These transactions are complicated, and they're riddled with rules that could make or break your investment. But they can be fruitful, as long as they are executed correctly.

Let’s take a look at 1031 exchanges, how they work and their benefits.

What Is a Section 1031 Exchange?

A 1031 exchange is an exchange of one real estate investment property for another that allows capital gains taxes to be deferred. Most swaps are taxable as sales, although if yours meets the requirements of Section 1031, you’ll either have no tax or limited tax due at the time of the exchange.

What Does a Section 1031 Exchange Look Like?

Listed below are the steps you can expect in a like-kind exchange:

1. Identify the right property to sell

Properties used as your primary residence or vacation home likely won't qualify for a 1031 exchange. You typically can only use this tax-deferment strategy for investment properties, such as a home that you're renting out.

2. Find a like-kind property to buy

The property you're buying needs to have a similar nature and characteristics to the one you're selling. Plus, you have to get the timing of your purchase and sale right to qualify for a 1031. Also, you can't use a 1031 exchange to sell a property in the U.S. and purchase one across borders.

3. Choose an intermediary

An intermediary will receive the cash from the sale of your investment property and use it to purchase your like-kind property. By keeping your funds in a secure escrow until the exchange is complete, you avoid receiving the money personally and making a capital gain. You don't have to use all the sale proceeds towards your next property. However, you'll have to pay capital gains tax now on any portion you keep.

4. Inform the IRS

File IRS Form 8824 with your tax return. This form describes the transaction, properties, timeline and other details of your 1031 exchange to ensure the IRS doesn't come asking for money.

Notable Aspects of a 1031 Exchange

It’s worth noting that you can change the form of your investment without cashing out or recognizing a capital gain. That allows your investment to continue to grow tax-deferred. There’s no limit on how frequently you can do a 1031 exchange. You can roll over the gain from one piece of investment real estate to another and another and another. Although you may have a profit on each swap, you avoid paying tax until you sell for cash many years later. If it works out as planned, you’ll pay only one tax at a long-term capital gains rate.

To qualify, most exchanges must merely be of like-kind. You can exchange an apartment building for raw land or a ranch for a strip mall. The rules are surprisingly liberal.

Benefits of a Section 1031 Exchange

While 1031 exchanges can be notoriously difficult, their advantages far outweigh the hassles. Here are just a few of the noteworthy benefits of a 1031 exchange:

- Tax deferment: Defer paying taxes and keep growing your long-term wealth.

- Investment: Swap your investment for a more promising property or real estate in a hotter market. You can also upgrade your investment. For example, you might trade a single-family apartment for a multifamily unit or swap raw land for an apartment complex.

- Depreciation reset: Reset the depreciable amount of your investment property to yield bigger tax benefits.

- Liquidity: Trade your property for a more liquid asset that will allow you more flexibility. For example, you might swap your property for a more in-demand type of home or for property in an up-and-coming market.

- Estate planning: Tax liabilities end with death. If you die without selling the property you've obtained through a 1031 exchange, your heirs won't have to pay the deferred taxes. Instead, they'll inherit the property at its stepped-up value.

1031 Exchange Timelines and Rules

Classically, an exchange involves a simple swap of one property for another between two people. However, the odds of finding someone with the exact property that you want who wants the exact property that you have are slim. For that reason, the majority of exchanges are delayed, three-party or Starker exchanges (named for the first tax case that allowed them).

In a delayed exchange, you need a qualified intermediary (middleman), who holds the cash after you sell your property and uses it to buy the replacement property for you. This three-party exchange is treated as a swap.

There are two key timing rules that you must observe in a delayed exchange.

45-Day Rule

The first relates to the designation of a replacement property. Once the sale of your property occurs, the intermediary will receive the cash. You can’t receive the cash or it will spoil the 1031 treatment. Also, within 45 days of the sale of your property, you must designate the replacement property in writing to the intermediary, specifying the property that you want to acquire.

The IRS says you can designate three properties as long as you eventually close on one of them. You can even designate more than three if they fall within certain valuation tests.

180-Day Rule

The second timing rule in a delayed exchange relates to closing. You must close on the new property within 180 days of the sale of the old property.

The two time periods run concurrently, which means that you start counting when the sale of your property closes. For example, if you designate a replacement property exactly 45 days later, you’ll have just 135 days left to close on it.

1031 Exchange Tax Implications: Cash and Debt

You may have cash left over after the intermediary acquires the replacement property. If so, the intermediary will pay it to you at the end of the 180 days. That cash — known as boot — will be taxed as partial sales proceeds from the sale of your property, generally as a capital gain.

One of the main ways that people get into trouble with these transactions is by failing to consider loans. You must consider mortgage loans or other debt on the property that you relinquish, as well as any debt on the replacement property. If you don’t receive cash back but your liability goes down, then that also will be treated as income to you, just like cash.

Example of a 1031 Exchange

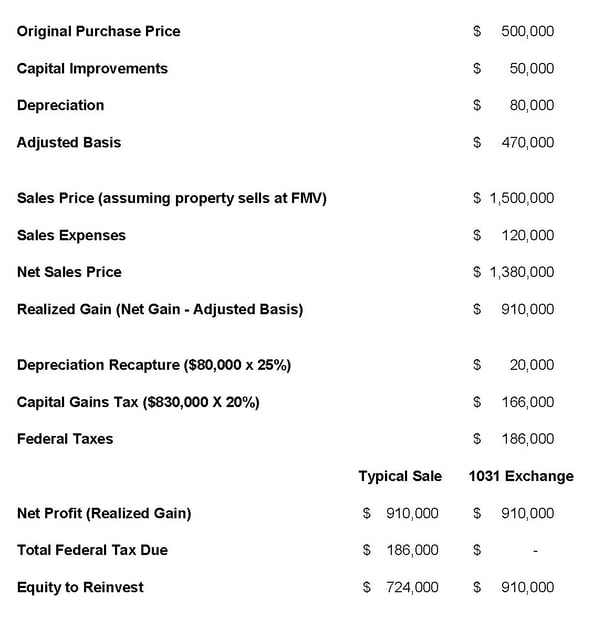

You decide to sell a condominium (relinquished property) with current fair market value of $1,500,000; however, at the time you purchased the condo, the FMV was $500,000. After you spent $50,000 in capital improvements and the property depreciated by $80,000, your adjusted cost basis was $470,000.

Your real estate broker finds an apartment building for $2,750,000 (replacement property). You purchased the property using the net proceeds from the sale of your condo within the 180-day period and successfully completed the 1031 exchange. If you had sold the condo without using a 1031 exchange, you would have paid $144,500 in federal taxes.

Through the use of a 1031 exchange, you deferred capital gains and depreciation recapture taxes, and had $144,500 more to invest into the replacement property.

The Bottom Line

A 1031 exchange can be used by savvy real estate investors as a tax-deferred strategy to build wealth. However, the many complex moving parts not only require understanding the rules, but also enlisting professional help — even for seasoned investors.

Need Help?

Contact us here or call 800.899.4623.