While students might be out for the season, summer is often the time when private schools hit the books to prepare for their yearly audit. Here's a quick guide on how to prepare your private school for this year’s audit.

1. Year-End Closing

The first order of priority is to complete your school’s year-end closing. Audit preparation cannot begin in earnest until the books are closed and the year-end adjustments are complete. Keep in mind that a good auditor will be available to answer any questions about accounting and financial reporting issues that come up as you close out the year. Often, it’s easier to resolve issues as they come up instead of right before an audit begins, which is why it’s important to work with an auditor that encourages questions outside of only the audit.

2. Account Reconciliations

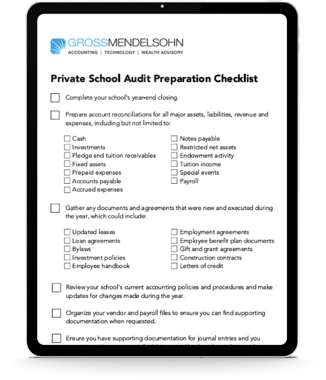

Once you have accurate financial information, jump into the account reconciliation process and prepare account reconciliations for all major assets, liabilities, revenue and expenses, including but not limited to:

-

Cash

-

Investments

-

Pledge and tuition receivables

-

Fixed assets

-

Prepaid expenses

-

Accounts payable

-

Accrued expenses

-

Notes payable

-

Restricted net assets

-

Endowment activity

-

Tuition income

-

Special events

-

Payroll

3. Document and Policy Review

Next, gather any documents and agreements that were new and executed during the year, including but not limited to:

-

Updated leases

-

Loan agreements

-

Bylaws

-

Employee handbook

-

Employment agreements

-

Employee benefit plan documents

-

Gift and grant agreements

-

Construction contracts

-

Letters of credit

You’ll also want to review your school’s current accounting policies and procedures and make updates for changes that you made during the year.

4. Vendor and Payroll Files

It’s also important to organize your vendor and payroll files before an audit. Your auditors will be testing samples of cash disbursements and payroll transactions, and it will make it easier to find the supporting documentation requested if your files are in good order.

5. General Journal Entries

Your auditors will request documentation supporting the general journal entries that you made during the year as well as at year-end. It’s a good idea to make sure there is supporting documentation for the journal entries, and you organize the entries so you can find documents when auditors make requests.

6. Meeting Minutes

Your auditors will likely request meeting minutes from your board of directors and audit and/or finance committee meetings. Ensure you have access to those meeting minutes or request access before your audit begins. Auditors will need to see meeting minutes for the fiscal year that they are auditing as well as any subsequent minutes. You’ll also need to provide the auditors with an up-to-date list of the board of directors for the fiscal year they are auditing.

7. Development Office

It’s a good idea to let your school’s development office know when the audit is starting. As part of the audit, the auditors will spend time testing the contribution revenue received during the year. The development office will most likely have the supporting documentation for new gifts, pledges and grants.

One best practice for private schools as they prepare for the audit is to work with your team to reconcile the development office’s gift records with the accounting records of the business office. This will ensure you correctly record all gifts received during the year according to the nature of the gift.

8. Tuition

When it comes to tuition income and advanced tuition, the auditors will be looking for a tuition schedule that provides the number of students by each tuition category as well information on the various payment plans offered. Let the admission office know when the audit will begin as the auditors may request to see admission applications.

9. Bank Documentation

Confirmation of the significant cash, investment and debt accounts held by banks is part of the audit. You can put together a listing of your school’s bank account names and numbers that the auditors can use to confirm the year-end balances with the banks. Your auditors will also need bank statements for the cash, investment and debt accounts as of year-end, so it’s a good idea to have those handy.

10. Planning the Audit Timeline

Work ahead to schedule the audit during a time that works best for your school. It might work best for your school to have the audit done in the summer before school starts if it tends to be quieter and there are fewer distractions then. On the other hand, if vacation schedules and preparations for the school year keep everyone busy, you might decide the fall is a better time for the audit. Whatever you decide it’s important to communicate this to the auditors so they can plan their schedules and ensure availability.

Need Help?

Contact us online or call 800.899.4623.