To properly value a business, adjustments may need to be made to the business’s revenue and expenses to normalize its income statement and accurately reflect the true economic performance of the business. One of the adjustments that commonly may be made during a business valuation is to normalize officers’ compensation, which may result in a more credible business value.

Determining Whether an Adjustment Is Needed

For pass-through entities, business owners can pay themselves through both officers’ compensation and distributions, so it is important to understand their reasoning behind which method they choose. Sometimes, owners may pay themselves a fair market rate through officers’ compensation and take the rest of the business earnings through distributions. In this scenario, a normalization adjustment is not needed.

Although it is common for owners to take less in compensation to lower payroll taxes, there are non-tax reasons why owners may pay themselves below market value. In economic downturns, such as the COVID-19 pandemic, owners may have paid themselves less throughout the course of the year to ensure they’d fulfill other payroll obligations, which would prompt the valuation analyst to make a normalizing adjustment.

Considerations for Making the Adjustment

Factors to consider while making an adjustment to officers’ compensation vary from business to business, but some main factors include:

Owner’s Experience and Qualifications

-

How many years of experience

-

Education level

-

Specialized industry knowledge

Owner’s Time and Contribution to the Business

-

Does the owner have a manager for day-to-day operations?

-

Does the owner work above or below a normal 40-hour weekly schedule?

-

Does the owner’s contributions to the client base outweigh what someone else could replace?

Compensation of Other Officers In the Company

-

What are other officers being paid?

A valuation analyst may use industry tools and outside resources to accurately adjust officers’ compensation. Then, through discussions with management and considering these factors and others, a reasonable adjustment can be made to officers’ compensation.

Result of Adjusting Officers’ Compensation

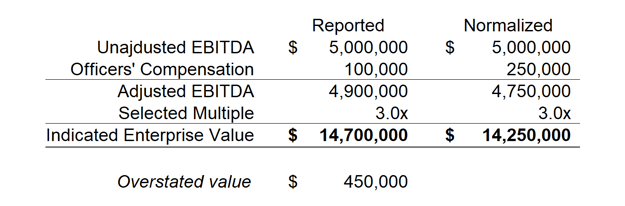

A business’s value is based on projected future earnings or cash flows. Without adjusting officers’ compensation, the cash flow of the business may overstate the resulting value as seen in this example:

The company originally reported $100,000 in officers’ compensation, but the valuation analyst deemed that to be too low. After adjusting compensation to a normalized value of $250,000, the value of the company changed rather significantly. Of course, it is possible for the opposite to occur, and the business to be valued too low without an adjustment, which is why it is important to understand why an owner paid themselves what they did.

Bottom Line

Underpaid or overpaid owners can distort what the true picture of what a company’s future economic benefits should look like. No matter the purpose for the valuation, officers’ compensation is a business expense that should be carefully scrutinized by the valuation analyst.

Need Help?

Our team of business valuation experts is here to help. Contact us here or call 800.899.4623.