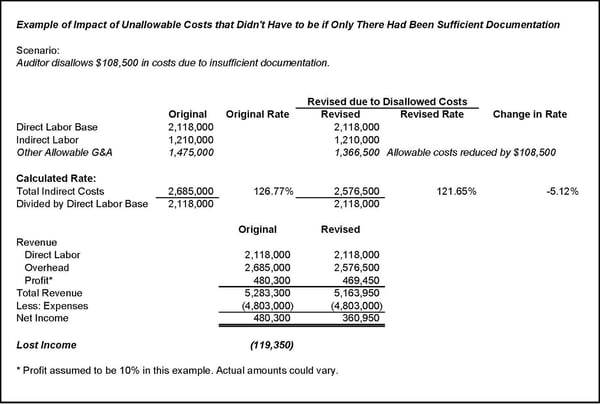

A few years ago we were hired by a government contractor to help them with a pretty big problem: their auditor disallowed over $100,000 in costs, and consequently, the business took a 5% hit to their indirect cost rate.

The saddest part, as we came to discover, was that the government contractor was the author of their own misery because of a lack of support for their expenses claimed.

Truth be told, this is pretty common. When my team does an indirect cost rate audit, we often find two problems:

-

Expenses without supporting documentation

-

Expenses with insufficient business purpose, especially when it comes to meals, travel and payment for services

The consequences of these disallowed costs that would have been allowed with the proper support can be severe, as their ultimate impact is the reduction in the indirect cost rate. Those unrecoverable costs go straight to the bottom line. As you’re aware, lower indirect cost rates mean less revenue and profit.

Here’s an example of the impact of unallowable costs on a government contractor’s financial health:

Our Guidance to Government Contractors on Allowable Costs

We recommend all of our clients prepare specific and explicit written policies, supported by procedures, that identify what is and what is not an allowable cost for a government contractor. These policies become a key part of both a new employee’s orientation, and periodic training refreshers.

Then, we ask our client’s finance staff to do periodic “surprise” checks of costs to make a determination whether the expenses are allowable, properly allocated, and have the necessary supporting documentation. This way, they catch errors earlier or identify gaps in policies that can hurt the company later.

A Dramatic Improvement

That’s just what our wayward new client did — installed and implemented policies, procedures, documentation and lots of training.

The result: a 95% reduction in disallowed costs and complete recovery of the indirect cost rate that had taken such a major hit.

If you’re facing a similar problem, contact us. While we may not be able to make the unallowable allowable, we can make sure that you don’t become the author of your own misery.

Need Help?

If you have questions or want guidance on how to avoid unallowable costs, we can help. Known for our expertise in conducting overhead audits, our Government Contracting Group works closely with construction contractors, architects, engineers and other government contractors to help them understand how overhead rates work and how to maximize compensation.

Contact us online or call 800.899.4623.