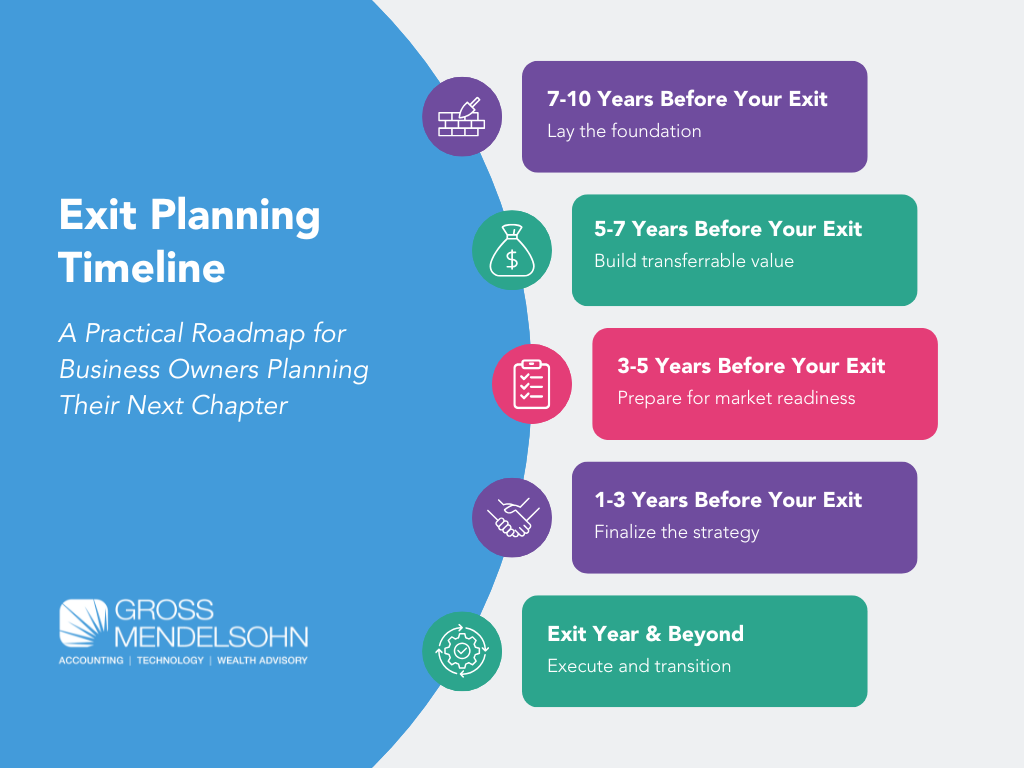

Most business owners don’t wake up one day ready to exit — and the most successful exits are rarely accidental. They’re the result of years of thoughtful planning.

This timeline provides a high-level roadmap of what business owners should be thinking about — and doing — as they move closer to a transition or sale. Whether your exit is 10 years away or much sooner, understanding the path ahead can help you make smarter decisions today.

Why Start 10 Years Out?

Exit planning is not just about selling a business. It’s about:

- Increasing flexibility and optionality

- Protecting and growing business value

- Reducing tax exposure

- Aligning the business with personal and retirement goals

Starting early allows owners to build value deliberately rather than reacting under pressure.

7-10 Years Before Exit: Laying the Foundation

At this stage, the focus is on strengthening the business and creating a long-term vision.

Key priorities include:

- Clarifying personal and financial goals for life after the business

- Understanding what drives value in the business

- Identifying risks that could limit future exit options

- Improving financial reporting consistency and accuracy

- Evaluating technology and operational systems

Why this matters

Decisions made early have the greatest impact on value — and the least disruption on day-to-day operations.

5-7 Years Before Exit: Building Transferable Value

This phase is about making the business less dependent on the owner and more attractive to future buyers or successors.

Key priorities include:

- Strengthening management and leadership depth

- Documenting processes and responsibilities

- Reducing customer and revenue concentration

- Tracking KPIs that demonstrate performance trends

- Beginning preliminary tax planning conversations

Why this matters

A business that can operate without its owner is easier to sell, easier to transition and often worth more.

3-5 Years Before Exit: Preparing for Market Readiness

Now the focus shifts toward financial clarity and credibility.

Key priorities include:

- Cleaning up financial statements

- Documenting owner add-backs and non-recurring expenses

- Considering reviewed or audited financials

- Getting a realistic understanding of business value

- Aligning exit timing with personal retirement planning

Why this matters

This is often when owners realize how buyers will view the business — and where adjustments can still make a meaningful difference.

1-3 Years Before Exit: Finalizing the Strategy

At this point, planning becomes more detailed and tactical.

Key priorities include:

- Finalizing the exit path (sale, succession, management buyout, etc.)

- Coordinating tax strategy with deal structure

- Preparing for due diligence

- Addressing remaining operational or reporting gaps

- Planning for post-exit income and cash flow

Why this matters

Well-prepared owners maintain control over timing, structure and outcomes — rather than reacting to buyer demands.

Exit Year & Beyond: Executing and Transitioning

The exit itself is just one milestone — not the end of the journey.

Key priorities include:

- Executing the transaction or transition

- Managing tax obligations and liquidity

- Transitioning leadership and relationships

- Implementing post-exit financial and estate planning

- Adjusting to the emotional and lifestyle changes of stepping away

Why this matters

A successful exit is measured not just by the transaction, but by what comes next.

Need Help?

Every business owner’s path is different, and timelines can accelerate or slow based on opportunity, health, market conditions or personal goals. The earlier you understand where you are on the timeline, the more options you have.

Contact us here or call 800.899.4623.