When I get into conversations with clients about how they arrived at their billing rates they usually have similar stories.

Often I will hear that they used formulas or rules-of-thumb from some trade group they belong to. Contractors often say those rates were determined years ago, and they use the same approach to this day.

I sometimes sense a lack of confidence among contractors when they consider the accuracy of that approach today.

Let’s discuss some common billing rate pitfalls to avoid.

1. Failure to Update Rates for Changes In Labor Burden and Overhead

The first mistake is avoiding what was discussed above: failing to update rates for changes in labor burden and overhead over the years.

It is not so much that the original frameworks were wrong in approach, but that they have not been adequately updated to reflect the current operations of the company. For purposes of this article I am defining labor burden as any variable cost immediately connected to labor, such as Social Security taxes and overhead, and other costs that are not directly linked to the specific contract.

If you are using one rate for each employee and not updating for each year’s change, you are not accurately accounting for the impact of this cost. Other costs in this area include Social Security and Medicare payroll taxes, state and federal unemployment taxes, and union costs if applicable. These costs do not typically fluctuate as much but certainly can, especially the unemployment rates.

Relative to labor burden updating, the biggest impact area concerns workers’ compensation rates and to a lesser degree, general liability rates. Depending on the type of construction work — for instance, roofing — you can have significant and wide-ranging rates depending on the specific type of work being performed. In addition to rate differences within policies, depending on work type you can experience significant rate changes with each new policy year.

2. Failure to Recognize Actual Utilization of Employees

The second general mistake our team typically sees is failing to recognize the actual utilization of employees.

Utilization relates to the billable or chargeable percentage of all time incurred by an employee. Even if you have the mentality that all time is billable, that still does not make it so.

Every employee is going to have some time, like vacations, holidays and training that needs to be recaptured in their rate at a minimum.

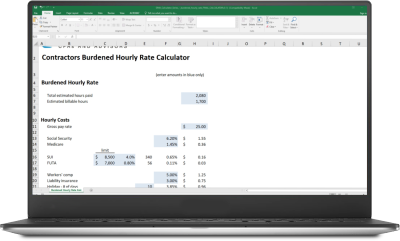

For instance, if you assume your employees’ billable hours are equal to the hours they are paid for, you are going to arrive at a billable rate that is too low. Our burdened rate calculator is designed to address this.

3. Failure to Reflect Overhead in the Rates

The third primary mistake is not accurately reflecting the overhead of the business.

Some of these types of costs, like health insurance, cell phones and vehicle costs, may be able to be assigned to specific employees. Other general overhead costs like rent, office salaries, utilities, data processing and others can’t be assigned to specific employees.

As we discussed in another post, Best Kept Secrets of Profitable Construction Companies, this is where a proper amount of information needs to be shared with those responsible for putting together bids and managing jobs.

Need Help?

Our free burdened rate calculator takes into account these three common problem areas and can be a useful tool in helping you analyze the accuracy of your construction company’s billing rates.

Contact us here or call 800.899.4623 if you have questions.