A few missed policies here, a lack of training there, a few insufficient time entry explanations later, and it’s simple to get an overhead rate that’s going to hurt your pocketbook when you do business with the federal or state government.

One of the biggest contributors to government contractors leaving revenue (and profits) on the table lies in the way they account for time and time reporting.

The consequences for poor time keeping and reporting on government contracts can range from running out of budget dollars and the possibility of losing out on change orders to getting ever larger bills for your annual audit because of the unreliability of your data.

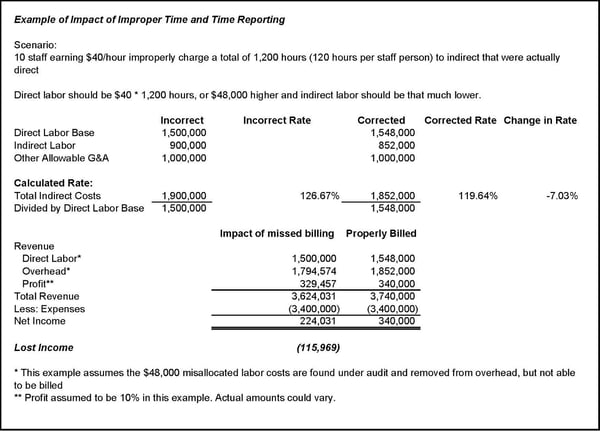

This example illustrates the consequences of poor time keeping:

Best Practices for Time Keeping and Time Reporting

In my decades of experience working with government contractors, I’ve seen my fair share of poor time keeping and reporting practices.

Here’s my take on seven best practices to getting time on your side:

-

Make sure your employees are recording their time on a daily basis

-

Regularly monitor and evaluate the time spent on a job to make sure you are within budget

-

Have sufficient explanations for time entry to determine if you can apply for a change order, whether the time has been properly charged; and for indirect efforts, have sufficient and specific categories of time being spent for proper allocation

-

Continually train your employees on proper time entry and recording practices, as well as other time-related policies and procedures

-

Perform ongoing reconciliations between time keeping and job costing systems

-

Do an internal check up to assess whether policies and procedures are being followed, and time is being properly charged and costed

-

Review indirect time charges for allowability and proper general ledger mapping

Why a Time Reporting Check Up Is Essential

Well in advance of your year end, do a check up to see if your time keeping is being captured and properly reported. Your accountant or internal audit/accounting staff can help with this review.

By doing this well before your next fiscal year, you’ll spot and resolve problems that may be negatively affecting your pocketbook.

Need Help?

We can provide guidance on accounting for time and time reporting. Contact us online or call 800.899.4623.