When it comes to stock options and deferred compensation in divorce, attorneys typically have many questions. The division of assets in any divorce is often a complicated process, but when stock options are added to the mix, the work becomes all the more difficult.

Let’s look at the questions attorneys ask most often — and the answers to each.

1. What are stock options?

To start at the beginning, stock options are a contract between an employee and employer. These stocks give an employee the right to a certain number of shares in the employing company at a fixed price for a designated amount of time.

Stocks can either be vested or nonvested:

-

Vested stock is stock that is considered exercisable. If a stock is exercisable, then the stock purchaser has an option to buy stock at a pre-fixed value that is generally less than the market value.

-

Nonvested stock is stock that is not yet eligible to be exercised at the pre-fixed value. Therefore, if the employee wishes to purchase the stock, it will be purchased at the stock’s market value.

There are also differences between Incentive Stock Options (ISOs) and Nonqualified Stock Options (NSOs), which differ in treatment when it comes to taxes. (If you're wondering, ISOs are treated more favorably.)

2. Are employee stocks considered marital or separate property?

When analyzing if an employee's stocks are considered marital or separate, a court may consider the following:

-

Are the stocks vested or nonvested?

-

Were the stocks granted to the employee in the form of compensation for past services or in the form of incentivized future services?

For stock options vesting after the separation date, there have been cases where the courts focused on whether the options were earned before or after the vesting date in determining marital versus separate classification (i.e., Pascale v. Pascale).

3. When are stock options considered "marital property"?

Stock options are potentially considered marital property in two instances:

-

If an employee is granted earned stocks, which are stocks given as compensation for past or current services, and if the stock was earned before the date of separation[1]

-

If an employee is granted vested stocks as an incentive for future services to the company, then the shares may be considered marital if the stock options vested before or during the time of marriage

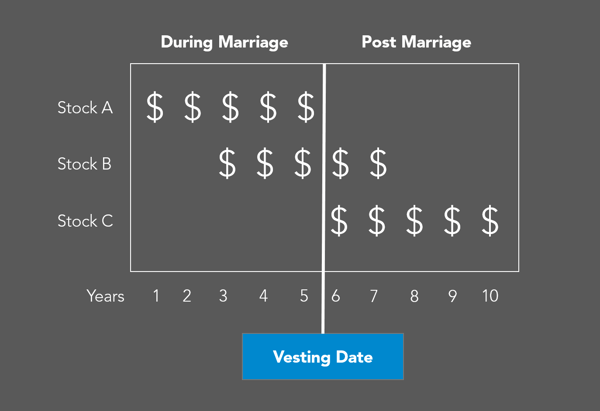

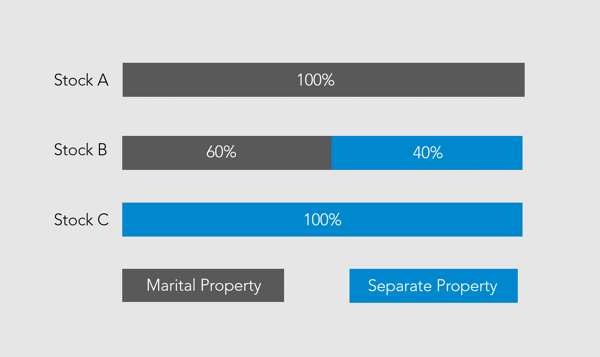

For an example of the how timing affects the classification of stocks as separate or marital property, see the charts below based on vesting.

4. How do I allocate stock options considered an incentive for future services?

No matter when the stock options vest, the stock options may be considered marital property if:

-

A spouse begins employment during the marriage, and

-

The stock options are given as compensation for past services

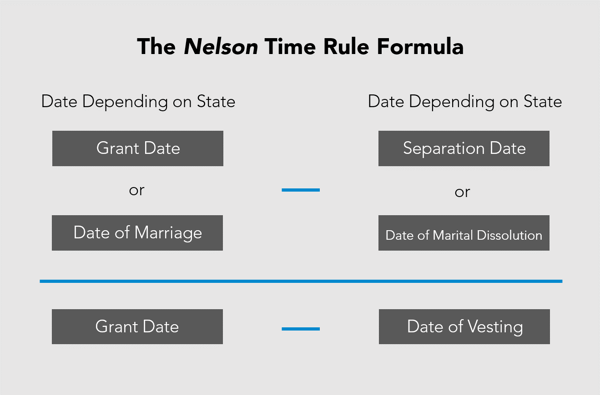

This allocation can be calculated by the Nelson Time Rule Formula to divide nonvested stock options into marital and separate property.

In the formula’s numerator, Nelson calculates the time (number of days) from the grant date or marriage date (depending on state) to the separation date or marital dissolution date (depending on state).

In the formula’s denominator, Nelson calculates the time (number of days) from the grant date to the vesting date.

By dividing the numerator by the denominator, Nelson calculates a percentage, which the court may consider in determining the marital versus separate components. See below for an illustration.

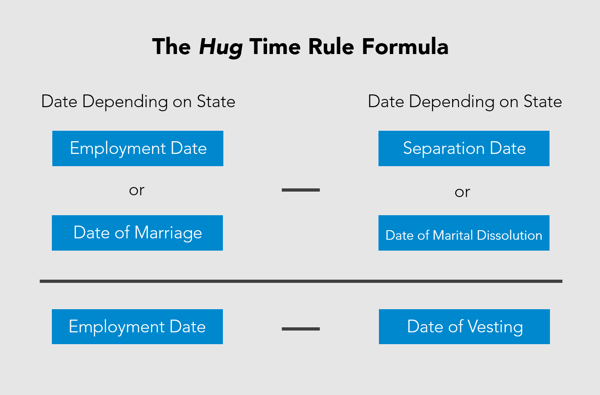

Another formula commonly used is the Hug Time Rule Formula, which differs slightly in that it focuses on the time from the employment date to the vesting date in the denominator of the formula. See below for an illustration.

5. How do I determine if stock options are granted for past or future services?

When determining if stock options are granted for past or future services, the following questions may help you in the decision-making process:

-

Is the stock option considered an employee bonus?

-

Does the stock option replace a set salary?

-

Will the employee’s performance alter the value of the stock?

-

Are the stocks offered as a sign-on incentive for new employees?

6. How do you distribute stock options in a divorce?

In general, stock options may be distributed based on a deferred distribution or a present valuation.

In a deferred distribution, an employee's marital partner may receive their marital share of stock if, as and when the stock options are exercised. This is commonly referred to as the "if, as and when" method. This method generally excludes employee stock options that are considered separate assets. When applying this method, the courts generally mandate the employee to exercise the stock options, but on occasion the courts will rule that the spouse exercise the options instead.

On the other hand, a present valuation addresses how much the marital portion of the stock options are currently worth and awards the employee’s spouse another asset of equal value. The problem with this valuation tactic is that it may cause an unequitable distribution of depressed stock values or possibly stocks that cannot be exercised. Even worse, the stock may become worthless.

Have More Questions?

Contact us online or call 800.899.4623.

[1] Or the end of marriage (depending on the state).