Resource Library

Free content, recordings and tools to keep you up to date

Filter By

Gross Mendelsohn Blog

Get the latest updates in accounting, tax and business best practices.

Streamline Your Year-End Close With Improved Technology

Learn how to improve your year-end close and stop depending on outdated processes.

How To Know When To Upgrade Your Accounting System

Learn when it's time to consider a new system and how to evaluate the right ERP system for your organization.

Payroll Update For Businesses & Nonprofits

Get the latest updates on Social Security and Medicare tax, income tax withholding, unemployment taxes, tax deposits and wage statements.

Cyber Security Wake-Up Call: What's Putting Your Organization At Risk?

Find out what’s putting your organization at risk of an attack and how to lessen your exposure to cyber threats.

.png?width=500&height=547&name=Family%20Owned%20Business%20Guide%203D%20Cover%20(500x547).png)

How To Transfer A Family-Owned Business To The Next Generation

This guide covers what you’ll need to consider when preparing to transfer your business to the next generation.

What Your Nonprofit's Financial Statements Reveal

The numbers on your nonprofit’s financial statements tell a colorful story — if you know what to look for. This video will help you better understand your financials.

Private School Audit Preparation Checklist

Prepare your private school for its next audit with this free checklist created by the private school auditors at Gross Mendelsohn.

CMMC Compliance 101 For Government Contractors

Learn how to achieve CMMC compliance for your government contracting business so you can secure contracts.

2023 Benchmark Study For Skilling Nursing Facilities In Maryland

This report provides a 360-degree overview of Maryland's skilled nursing industry, allowing you to see how your facility compares to others in the state.

Private School Accounting & Finances: Best Practices Guide

Private school leaders, board members and finance staff ― discover what you need to know about your school's financial statements, budgeting, accounting and financial reporting.

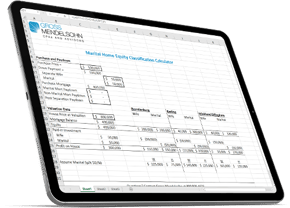

Marital Home Equity Classification Calculator

This calculator helps family law attorneys quickly calculate the division of marital assets using the three most widely-accepted methodologies.

Demystifying The Audit: A Guide For Nonprofit Board Members And Executives

Learn the role audits play in managing your nonprofit's financial health.

9 Myths About How Much Your Business Is Worth

Get a better understanding of the factors that come into play in determining what your business is worth.

14 Lessons For Selling Your Business Easier, Faster And Smarter

This guide reveals lessons we’ve learned as CPAs and business valuation experts that can help you sell your business pain-free.

Guide For The Board: Responsibilities In Managing A Nonprofit Endowment

This whitepaper outlines five key principles to follow in setting up and managing an endowment, six “must have” pieces of a board endowment policy statement and more.

How To Protect Your Assets From Employee Fraud

5% of revenues are being stolen by employees, but your organization can and must protect its assets. Learn the most critical aspects of fraud prevention.

Divorce Case Checklist For Family Law Attorneys

This checklist provides recommendations for navigating the discovery of hidden assets, avoiding income manipulation and ultimately maximizing divorce clients' equitable results.

Business Exit Planning Checklist

Learn how well you’re prepared to leave your business and fund your retirement. This checklist covers retirement strategy, tax planning, succession planning and transferring your business.

.png?width=400&height=474&name=Estate%20Planning%20Checklist%20mockup%20image%20(500px).png)

Estate Planning Checklist

This free checklist shows the components of an estate plan and how to plan for the future transfer of your wealth to the next generation.

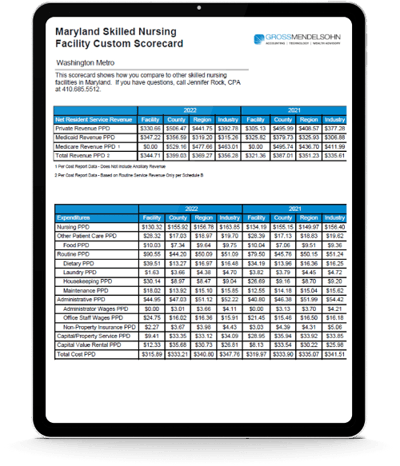

Maryland Skilled Nursing Facility Custom Scorecard

Learn how your skilled nursing facility compares to other providers in Maryland and your region.

Work In Progress (WIP) Calculator

Accurate profit projections and better cash flow management start with a handle on your work in process.

Overhead Rate Calculator For FAR Audits

A downloadable Excel calculator for architects, engineers and government contractors for identifying a general overhead rate and a total overhead rate.

Burdened Hourly Rate Calculator For Contractors

This downloadable burdened hourly rate calculator helps construction contractors develop hourly rates for your employees.

Membership Retention Calculator For Associations

This free calculator will shows exactly where your association stands with membership growth.

Private School Budget Template

This simple Excel calculator can help you create your private school's next budget.

Nonprofit Audit RFP Template

Solicit proposals with confidence. Use our free template for your nonprofit's next financial statement audit RFP.

Nonprofit Budget Template

This easy-to-use Excel template can help you create your nonprofit's next budget.

5 Essential Steps To Building A Better Board For Your Nonprofit

Learn how to keep your board of directors engaged and passionate about your nonprofit's success.

Pushing Your Nonprofit To The Next Level With A Strategic Plan

Learn how to strengthen your nonprofit with a strategic plan, and the role of mission and vision statements.

Fraud Prevention For Nonprofits: Avoiding Fraud Schemes And Fraudsters

Learn the best fraud prevention tactics, what to do if you discover fraud in your organization and common fraud schemes to watch for.

Private School Case Study: Finding Alternative Funding Sources For Growth

Learn how a private school secured a loan to protect their endowment and, as a result, created $3 million in value for the school.

Construction Case Study: Contractor Finds Easy Way To Increase Bottom Line By 8%

Discover how one contractor increased their bottom line by adjusting their burdened hourly rate.

Exit Planning Case Study: Selling The Business To Key Employees

Learn how exit planning created a win-win opportunity for a retiring business owner.

Strategic Planning Case Study: Nonprofit Dreams Big, Creates New Mission And Staff Gains Voice

Discover how the Maryland Science Center leveraged strategic planning to develop a clear, action-oriented five-year plan.

How Divorce Attorneys Can Leverage A Financial Advisor Before & After A Divorce

Learn how divorce attorneys can work with financial advisors during and after settlement.

No Results