If you’ve worked on public projects — or plan to —“surety bond” is probably a familiar term. Whether you are bidding on a government contract or taking on a large private job, surety bonds are often required before you can even get started with a construction project.

But what exactly is a surety bond? Why does it matter to your construction business? And how does it protect both you and the project owner?

This article covers the basics of surety bonds from a contractor’s perspective: how they work, why they are important, and what you need to know to stay compliant and competitive in today’s construction environment.

What Is a Surety Bond?

A surety bond is a three-party agreement that guarantees you, as a contactor, will meet the obligations outlined in your contract.

The Three Parties In a Surety Bond

- Principal — the contractor (you)

- Obligee — the project owner (public or private)

- Surety — the bonding company that guarantees the contractor’s performance

What Does a Surety Bond Do?

If you, as the contractor (the principal), do not meet the terms of a contract — whether due to delays, poor workmanship or default — the surety steps in to protect the project owner (the obligee). That might mean covering the cost to finish the job or hiring another contractor to complete the work. But a surety bond is not insurance. If the surety has to step in, you are still responsible for paying them back. In short, the bond is there to protect the project owner, but it holds you accountable for following through on your commitments.

Why Are Surety Bonds Important?

Surety bonds are not just paperwork but an essential part of running a credible, competitive contracting business. Here’s why they are so important:

Required by Law

If you are bidding on public projects, surety bonds are not optional. At the federal level, the Miller Act requires performance and payment bonds for all contracts over $150,000. At the state level, every state has their own version of this rule, called a Little Miller Act, which applies to state-funded projects.

Risk Management

Surety bonds protect project owners from financial loss if a contractor defaults, walks off the job, or fails to pay subcontractors, laborers and suppliers.

Builds Trust

Having bonding capacity shows customers that you are financially stable, trustworthy and capable of completing the work. Look at it as a business asset that gives you a competitive edge.

Most Common Types of Construction Surety Bonds

In construction, there are four primary types of surety bonds that contractors are most likely to encounter. Each serves a different purpose, but they all help build trust, manage risk and keep projects on track.

Bid Bond

Purpose: Guarantees that if you are awarded the project, you will enter into the contract and provide the required performance and payment bonds. This gives the project owner confidence that you are serious, qualified and financially stable.

Example: If you win a $1 million bid and back out, the surety may cover the cost difference if the owner must hire a higher bidder.

Performance Bond

Purpose: Guarantees that you will complete the project according to the contract terms. This ensures that if you default, the surety may step in to finish the job or reimburse the project owner for losses.

Example: If your company goes under mid-project, the surety could hire another contractor to complete the work.

Payment Bond

Purpose: Guarantees that you pay subcontractors, laborers and suppliers involved in the project. This protects your subcontractors and suppliers from non-payment and shields the project owner from liens or legal issues.

Example: If you fail to pay your electrical subcontractor, they can file a claim against your payment bond.

Maintenance Bond (Optional)

Purpose: Covers defects in workmanship or materials for a specific period after the project is completed. This gives the obligees a peace of mind that issues will be addressed even after the project is completed.

Example: A 12-month maintenance bond may cover a faulty HVAC installation that causes problems post-completion.

How to Get Bonded As a Contractor: A Step-by-Step Guide

Getting bonded is an important step in growing your contracting business, especially if you plan to work on public or large private projects. Surety bonds open the door to bigger opportunities. Here’s a simple breakdown of how to get bonded and what you can do to strengthen your bonding capacity over time.

Step 1: Choose a Bond Agent or Surety Broker

Start by finding someone who specializes in construction bonds. A knowledgeable bond agent will understand your business, help you navigate requirements and match you with a reputable surety company.

Step 2: Complete the Application

Once you’ve chosen a bond agent, you will need to provide detailed information about your business. This usually includes:

- Financial statements

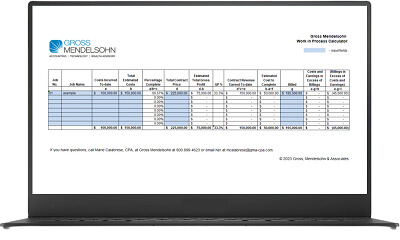

- Work-in-progress (WIP) schedules

- Details of your work experience

- References from owners, banks or suppliers

The surety wants to understand your ability to manage risk and deliver on your commitments.

Step 3: Underwriting Process

The surety will assess your company’s qualifications to determine whether they can back you and for how much. They will evaluate:

- Credit score (both personal and business)

- Financial health of your business

- Past project performance and experience

- Current backlog and future workload

Remember that surety bonds involve indemnity, meaning if the surety pays out a claim, you are responsible to reimburse them. This is why financial strength and track record matter so much.

Step 4: Approval and Bond Issuance

When you are approved, the surety will issue your bond and set your bonding capacity:

- Single limit — The maximum bond you can get for one project

- Aggregate limit — The total amount of bonded work you can have at one time

Once you are bonded, you will be able to bid on projects that require it and show customers you are a contractor who can be trusted.

Tips to Increase Your Bonding Capacity

If you want to qualify for larger projects, you will need to demonstrate that you can handle more risk. Here’s how:

- Keep your financials accurate and up to date and understand what sureties look at when they review a contractor’s financial statement

- Maintain a strong business and personal credit score

- Complete projects on time and within budget

- Manage your backlog carefully

- Work with a CPA who specializes in construction

Getting bonded might seem intimidating at first, but it’s a major milestone in becoming a trusted, growth-ready contractor. With the right preparation, you will be in a strong position to land better jobs and build a more resilient business.

Need Help?

Contact us here or call 800.899.4623.