Manufacturers, like most businesses, are always looking for ways to minimize expenditures, yet many fail to realize they are leaving money on the table every year when they file their taxes. The following are just a few federal and state credits that Maryland manufacturers should know about:

There’s a Difference Between a Tax Deduction and Credit

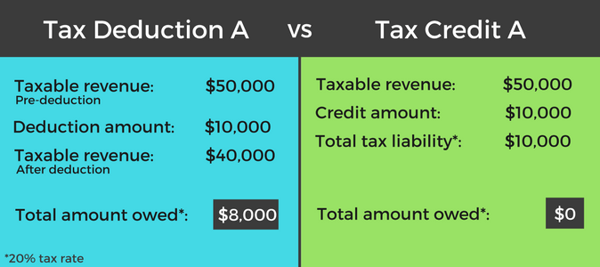

Before we jump in, it’s important to note that tax credits and deductions are two different financial tools:

- A deduction reduces the total dollar amount you are responsible for before your tax liability is calculated. This means if you have a $10,000 deduction and made $50,000 in revenue last year, you will deduct $10,000 from your revenue so when you file your taxes, your tax liability is determined based on a revenue of $40,000 instead of $50,000.

- A tax credit is a dollar-for-dollar reduction in taxes that your business owes. This means if you have a $10,000 tax credit, you will deduct $10,000 from your overall tax liability. So, if you owe $10,000 in taxes, you will end up paying $0 that year.

1. The R&D Tax Credit

The R&D Tax Credit (or more formally known as the IRC Section 41 Research and Experimentation Tax Credit) is commonly missed by manufacturers for several reasons:

- They aren’t aware the credit exists

- They are aware the credit exists but don’t know what the rules of the credit are

- They are aware the credit exists, know the rules of the credit but don’t think the credit applies to them

The R&D Tax Credit is a dollar-for-dollar reduction in tax liability that can be passed forward for up to 20 years. For Maryland manufacturers that qualify for the credit, there is also a credit against regular state tax for businesses that incur qualified research expenses within the state.

To be clear, the R&D Tax Credit involves more than research and includes things like: the development of new processes, and techniques, formulas and design of new projects. For example, if a manufacturer creates a new process to increase the efficiency and improve the manner in which something is manufactured, they may qualify for the credit.

The total amount of credits depends on the amount of eligible expenses incurred, with a limit of $4.5 million for all Maryland businesses that apply. To claim the credit, a manufacturer must attach Business Tax Credits Form 500CR to the Corporate Income Tax Return Form 500. For some tips from the IRS for how manufacturers can qualify for the R&D Credit, visit the IRS website.

2. Maryland Enterprise Zone Tax Credit

In order to stimulate business in economically distressed communities throughout Maryland, manufacturers located in “enterprise zones” are eligible for income tax credits. There are currently 31 enterprise zones in Maryland (get the complete list of enterprise zones), with a highlighted focus in Baltimore City and Prince George’s County.

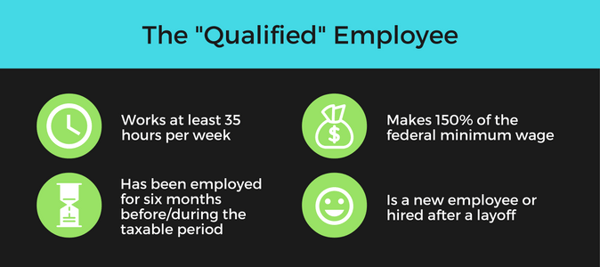

To qualify for the credit, manufacturers must be located in an eligible enterprise zone and employ “qualified” employees, meaning the employee must:

- Work at least 35 hours per week

- Have been employed for a six-month period before or during the taxable year in which the credit is claimed

- Be a new employee or an employee that was rehired after being laid off for more than a year

- Make at least 150 percent of the federal minimum wage

Maryland manufacturers located in an enterprise zone may claim credit of $1,000 per new worker. For economically disadvantaged employees, the credit increases to a total of $3,000 per worker for the first year. Business entities are allowed an enhanced tax credit for focus area employees of up to $1,500 or up to $4,500 for economically disadvantaged individuals. For more information on the enterprise zone tax credit, visit the Maryland Department of Commerce’s website.

3. Maryland Bio-Heating Oil Credit

This tax credit can be earned for the purchase of bio-heating oil equal to three cents per gallon and not to exceed $500. The bio-heating oil must be used for the purpose of space and water heating. To qualify, a business must apply to the Maryland Energy Administration and file a Form 500CR with their tax return. To learn more about the credit, visit the Maryland Energy Administration website.

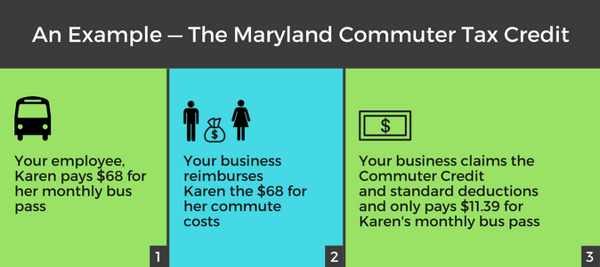

4. Maryland Commuter Tax Credit

Maryland businesses that provide commuter benefits in the form of transit passes, transportation to work, or reimbursements for carpooling expenses to in-state employees, are eligible for a tax credit up to 50 percent of the cost of the benefits limited to $100 per month per employee. To learn more about how to qualify for this credit, check out our quick guide on how to qualify for the Maryland Commuter Tax Credit.

5. Maryland Long-Term Care Insurance Credit

Maryland businesses that provide long-term care insurance as part of an employee benefits package are eligible for a tax credit equal to 5 percent of the costs and is limited to the lesser of $5,000 or $100 for each employee covered under the plan. To claim the credit, the business must attach Business Tax Credits Form 500CR to the Corporate Income Tax Return Form 500. For more details on the credit, visit the Comptroller of Maryland website.

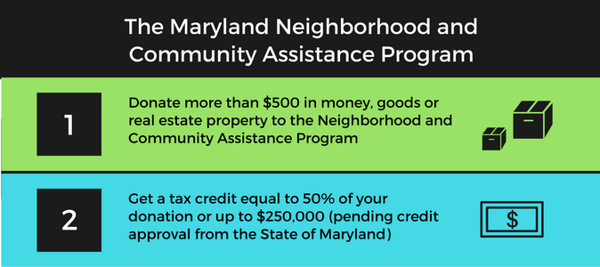

6. Maryland Neighborhood and Community Assistance Program

Maryland businesses that make a donation of money, goods or real estate property of at least $500 in value to the Neighborhood and Community Assistance Program are eligible for a tax credit equal to 50 percent of their donation limited to the lesser of $250,000 or the taxpayer’s liability for the year of donation, with any unused credit being allowed to be carried forward for five years.

Businesses must receive approval from the Department of Economic Competitiveness and Commerce prior to claiming the credit. To learn more, visit the Comptroller of Maryland website.

7. Maryland Heritage Structure Rehabilitation Tax Credit

Owners of income-producing properties in Maryland have the opportunity to earn a state income tax credit for renovating historic buildings under the Maryland Heritage Structure Rehabilitation Tax Credit. To learn more about how to qualify, visit the Maryland Historical Trust website.

8. Maryland Small Commercial Tax Credit

Under Maryland’s Small Commercial Tax Credit, small commercial rehabilitations, defined as projects that do not exceed $500,000 in expenses and are not used for more than 75 percent residential rental purpose, may receive a credit up to $50,000 in a 24-month period. The program is capped at $2 million worth of credits a year. To learn more about the credit, visit the Maryland Historical Trust website.

9. Maryland Competitive Commercial Tax Credit

Under Maryland’s Competitive Commercial Tax Credit, larger, income-producing, “commercial” rehab projects are potentially eligible to earn a state income tax credit that is equal to 20 percent of eligible rehabilitation expenses. The program is capped at $5 million worth of credits a year. To learn more about how to qualify, visit the Maryland Historical Trust website.

Need Help?

Contact us online or call 800.899.4623.