Figuring out how long you need to keep your tax records can be tricky. The easiest (and vaguest) answer is that it depends.

The general rule of thumb, according to the IRS, is that you need to keep records that support an item of income, deduction or credit until the period of limitations for that tax return runs out. The period of limitations is the time in which you can A) amend your tax return to claim a credit or refund and B) the IRS can assess additional tax.

Periods of Limitations That Apply to Income Tax Returns

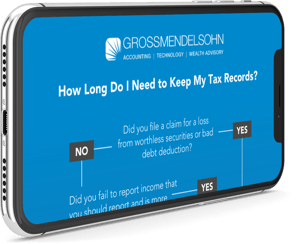

Here are the periods of limitations that apply to income tax returns, as provided by the IRS. Get a downloadable and printable flowchart of this information here.

-

Keep records for three years if situations (4), (5), and (6) below do not apply to you

-

Keep records for three years from the date you filed your original return or two years from the date you paid the tax, whichever is later, if you file a claim for credit or refund after you file your return

-

Keep records for seven years if you file a claim for a loss from worthless securities or bad debt deduction

-

Keep records for six years if you do not report income that you should report, and it is more than 25% of the gross income shown on your return

-

Keep records indefinitely if you do not file a return

-

Keep records indefinitely if you file a fraudulent return

-

Keep employment tax records for at least four years after the date that the tax becomes due or is paid, whichever is later

What About Property Records?

The IRS recommends keeping property records until the period of limitations expires for the year in which you transfer ownership of the property. You’ll need these property tax records to figure out depreciation, amortization or depletion deduction, and figure out the gain or loss when it’s time to transfer ownership.

In the instance that you received property in a nontaxable exchange, your basis in that new property is the same as the basis of the property that you gave up, plus any money you paid. You must keep records for both the old and new property until the period of limitations expires for the year that you transfer ownership of the property.

Can I Get Rid of My Tax Documents After the Period of Limitations?

You might want to check with your insurance company and creditors before you get rid of any tax documents. You might be required to keep tax records beyond the period that the IRS requires as a condition of another policy or agreement.

Need Help?

If you have any questions, contact us here or call 800.899.4623 for help.