When an insured party with proper commercial coverage has an interruption due to a covered loss, they may be entitled to recover the loss of their business income. But how is the loss of business income calculated for insurance claims?

Business income is generally defined by each specific policy, but typically it is computed as the net income lost plus continuing expenses. I usually find it easier to present as the business’s lost sales minus the saved (noncontinuing) expenses. Through either presentation, the same value of loss of business income is determined. This coverage is generally designed to make the business whole as if the loss or interruption never occurred.

Step 1 — Calculating Lost Sales

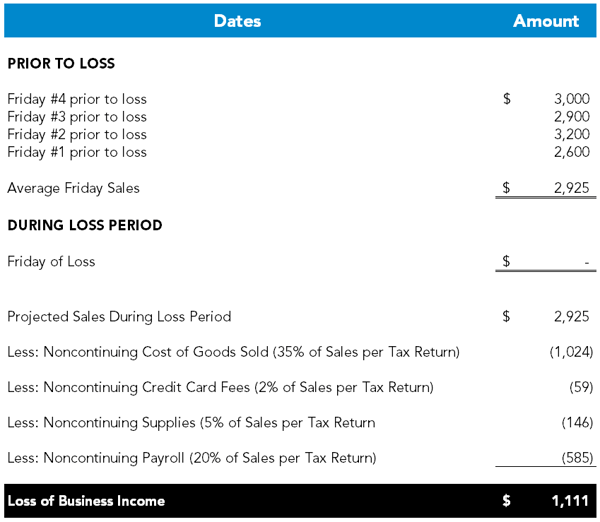

First, I calculate the business’s lost sales, which is generally done by using historical sales data. Let’s use as an example a pizza restaurant that is forced to close on a Friday. To calculate lost sales I may use sales figures from the previous four Fridays to determine an average Friday sales and use that average as the projected sales lost due to the interruption.

When projecting lost sales, I frequently am trying to get an apples-to-apples comparison in the lookback data. For instance, I generally would not use historical Tuesday sales figures to project Friday sales since Fridays are busier for a pizza restaurant. There are a lot of factors to consider when analyzing lost sales, such as seasonality, days of the week, special events and holidays.

Step 2 — Calculating Noncontinuing Expenses (Saved Expenses)

Once I calculate the lost sales, I then determine the expenses the business will save as a result of the lost sales and suspended operations. These saved expenses are referred to as “noncontinuing expenses.”

Generally, I review the business’s most recent tax return or profit and loss statement to understand the business’s expenses and those expenses that will be saved as a result of the lost sales or suspended operation.

Using the pizza restaurant example, the typical expenses that would be saved due to a one-day closure would be cost of goods sold, supplies, credit card fees and potentially payroll. From the profit and loss statement or tax return, I can determine the business’s average ratio of these expenses as a percentage of sales, which then will be applied to the sales lost due to the interruption.

A Real-life Calculation

A pizza restaurant with the proper commercial coverage is closed on a Friday due to a covered loss. Using historical point of sales reports, I determine the business’s average Friday sales prior to the loss are $2,925. I project the business’s lost sales during the closure to be $2,925. Based on my review of the business’s income tax return, I gather that cost of goods sold is 35% of sales, credit card fees are 2% of sales, supplies are 5% of sales, and payroll is 20% of sales. If the business lost sales of $2,925, I would estimate $1,024 ($2,925 x 35%) of saved cost of goods sold and apply this same analysis to all noncontinuing expenses. I then take the total lost sales of $2,925 and subtract the total noncontinuing expenses of $1,814 to calculate the estimated loss of business income to be $1,111.

Need Help?

Our Forensic, Valuation & Litigation Support Group prepares loss calculations for insurance claims. Contact us online or call 800.899.4623.