A how-to guide for family-owned business owners on transferring your business to the next generation.

Services For Construction & Real Estate Businesses

Get practical advice for being more profitable ― from CPAs who know your industry.

Build A Stronger Future

Construction Contractors

Whether it’s advice on pricing, labor trends or boosting profitability, our construction industry specialists help companies manage all aspects of their business.

Real Estate Companies

Working in real estate can be thrilling, but it also carries certain risks and challenges. We help real estate developers, property managers and investors mitigate risks and maximize opportunities.

Architecture & Engineering Firms

From shareholder compensation to succession planning, overhead rate audits, investment management to technology, our services for architecture and engineering firms extend far beyond financial statements and tax planning.

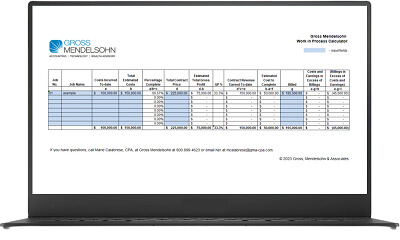

Free WIP Calculator

How We Help

Whether you need a financial statement audit, tax planning, advice on pricing, succession planning or help with your company’s technology, Gross Mendelsohn’s Construction & Real Estate Group is here to help.

Financial Statement Audits

Work with seasoned auditors who have construction and real estate expertise to help ensure your financial statements are fairly stated and accurately presented.

Tax Planning & Compliance

We provide innovative, proactive tax advice, which includes bold yet appropriate application of tax laws to your unique situation.

Succession Planning

We’ll help you plan ahead by developing a win-win plan for you, your successor and your business’s future.

Overhead Rate Audits

We know how critical these audits are for supporting a justifiable overhead rate that lets your firm protect cash flow and maintain access to government contracting opportunities.

Employee Benefit Plan Audits

Our seasoned auditors can audit your employee benefit plan, whether it’s a 401(k), defined contribution, defined benefit or ESOP plan.

Cost Segregation Studies

Accelerate tax deductions for your real estate investments with a cost segregation study.

Software Solutions

Get your job costing, project management and accounting under one secure roof by working with our Technology Solutions Group.

Cyber Security

Hackers are lurking around every corner of the internet. Don't let your business fall victim to a cyberattack.

Managed IT Services

A managed services plan gives you access to a well-maintained, secure IT infrastructure for your organization at a fixed monthly cost. Our IT experts are ready to help.

What Clients Are Saying

“Gross Mendelsohn handles all of our financial and tax needs extremely well. This allows us to do what we know best — run our construction business — and not worry so much about the numbers.”

Kathy Christopolis, Co-Owner

Columbia Roofing

“Our multi-generation business continues to grow and Dan Larson gives us tax planning strategies to support that growth.”

Karen Beitzell, Owner

Beitzell Fence Company

“Marie Calabrese made me aware of what good accounting firms do for their clients. She genuinely looked out for our business and future tax situation by advising us to convert to an S corp to save us money on our taxes.”

Dennis McCartney, Vice President

B&B Welding Company, Inc.

“They know what’s going on in the industry, the economy, and have an excellent reputation among banks and bonding companies.”

Barbara Kight, President

PDI-Sheetz Construction Corporation

“Their excellent understanding of our business, procedures, management team ― and the construction and real estate industry ― make the firm a great fit for Questar.”

Joseph Davies, Former Chief Financial Officer (retired)

Questar

Businesses We Work With

Resources For Construction & Real Estate Companies

This free calculator will help you develop hourly rates for your employees, accounting for expenses like taxes, insurance and paid time off.

Plug in the numbers and the calculator does the rest to identify a general and total overhead rate.