With the globalization of business, you’ll want a source of dependable revenue management to avoid economic mishaps in your service organization.

Raise your hand if you use multiple spreadsheets to track financial data. You’re not alone. In this day and age, revenue management can no longer live in spreadsheets.

Fortunately, there’s a better way to manage revenue recognition. It’s called NetSuite.

NetSuite is an ERP system for service businesses that helps simplify the complexities of evolving revenue recognition mandates, regardless of whether a sale encompasses a single performance obligation, a series of obligations spanning a time period, or diverse obligations in a bundle. The results enable the automation of revenue policy for compliance, real-time revenue intelligence and actionable data.

Revenue Recognition

Sales agreements can include a combination of products and services (e.g., a security system with installation and monitoring) or a series of deliverables (e.g., consulting services). Whether an equal amount of revenue must be recognized at fixed intervals or different amounts must be recognized at different intervals, NetSuite revenue management enables you to schedule revenue to be recognized at the proper time automatically.

Let’s take a look at some of the powerful revenue management tools NetSuite has to offer.

Revenue Policy Automation

Easily manage exceptions as they arise by holding revenue, updating revenue recognition schedules or making other changes.

Automate Planning

Automatically schedule revenue to recognize in the appropriate period based on rules. Re-usable revenue rules govern the triggers, the creation and commencement of a revenue plan associated to a sales transaction, as well as the plan duration.

Automate Unbilled Revenue Recording

Record unbilled revenue automatically by identifying revenue elements without corresponding bills, saving time during closing.

Support Multi-Currency Transactions

Ensure that fluctuations in exchange rates are appropriately accounted for in each period.

Manage Balance Sheet Accounts

Automatically adjust contract liability (deferred revenue) and contract asset balances based on real-time billings and revenue data.

View Financials In Real-Time

Automatically post to the general ledger from revenue plans — on your schedule, as frequently as you wish.

Flexible Forecasting

Provide flexible forecasting to accommodate revenue projection updates based on real-time business events, such as project plan updates or planned revenue withheld to a future period.

Multiple Performance Obligations

Contracts with multiple components delivered at different points in time require special attention, as revenue recognition depends on how and when each component is delivered. NetSuite’s robust capabilities provide configurable revenue schedules for even the most complex agreements.

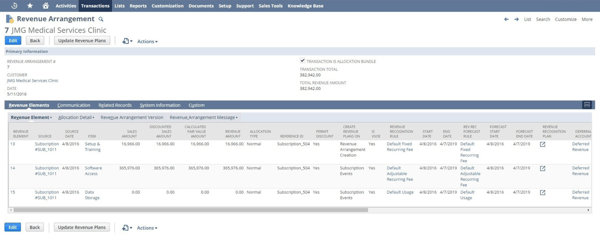

Flexible revenue contracts drive an agile and accurate view of the revenue contract. Revenue arrangements are containers for revenue elements (performance obligations). Elements have individual attributes such as revenue rule, revenue plan start and end dates, and revenue allocated amount. Revenue elements can be merged across linked orders or contracts, or split into multiple arrangements, to accurately represent the revenue contract regardless of how the revenue source transactions are managed and billed.

Managing Complex Allocations

Managing revenue correctly when products and/or services are delivered over multiple accounting periods can be challenging. Industry standards dictate how contract prices must be allocated based on what is being delivered when. NetSuite’s comprehensive allocation features enable systematic compliance with ASC 606/IFRS 15.

Dynamic standalone selling price defines the standalone selling price (SSP) as either a constant or a dynamic formula. Formulas can be based on information within other revenue elements. For example, an SSP for support based on a percentage of licenses within that contract. Item revenue groups allow items with identical requirements to have the same standalone selling price, eliminating duplication.

The ability to add user defined dimensions allows a single item (or group of items) to have multiple SSPs and meet stratification requirements.

The powerful allocation calculator leverages standalone selling prices to automatically allocate arrangement consideration across all elements within the arrangement, including support for ASC 606/IFRS 15 standards.

Revenue Recognition for All Industries

Companies have traditionally been required to follow industry specific guidance for revenue generating activities relating to the licensing, selling, leasing, hosting, or marketing of products and services.

These arrangements encompass multiple deliverables or elements: software and any combination of specified or unspecified enhancements, post-contract customer support, services and additional licenses. Packaged software arrangements with multiple elements often have different dates of delivery (e.g., product and support), requiring accounting departments to recognize and defer revenue amounts appropriately. ASC 606/IFRS 15 includes similar principles with the impact extending beyond the industries that have traditionally fallen under the guidance.

Support Revenue Recognition Over Time

Recognizes revenue over time based on output (e.g., units produced, hours delivered) or input (e.g., resources consumed, costs incurred).

Support Percentage-of-Completion

Accounting support revenue accounting for projects leveraging percentage-of-completion mechanisms.

Support Event Driven Revenue Plans

These plans will allow you to align revenue recognition with event triggers. A single performance obligation can be associated with multiple plans in order to support partial fulfillments or billings.

Revenue Recognition in Accordance with Multiple Accounting Standards

The globalization of business today is powered by several factors, including global capital markets, foreign direct investment and economic interdependence. In order to report financial results accurately within revenue recognition mandates based on multiple accounting standards (e.g., GAAP, IFRS), accounting departments worldwide can leverage a powerful multi-book accounting engine that can record and post revenue-related activity to all books concurrently eliminating data entry replication and manual intervention.

Let’s look at a few noteworthy features.

Book-specific Standalone Selling Prices, Revenue Rules, Plans and Arrangements

Automate concurrent posting to all books as business transactions occur in real-time, versus “after the fact” posting or waiting until the end of the period to replicate data entry and post adjustments.

Book-Specific Foreign Currency Management

Enable accounting departments to use book-specific functional currencies when calculating the general ledger impact, including the realized and unrealized foreign currency gain/loss amounts per transaction.

Book-Specific Financial Reporting

Enable real-time revenue visibility for any book, anywhere, anytime.

Need Help?

Want to see NetSuite in action? Contact us online or give us a call at 410.685.5512 to arrange demo.