Many nonprofits see IRS Federal Form 990 as an informational return that they send to the IRS every year, but in reality, the Form 990 is much more than that. Your organization’s 990 is open to public inspection, which means that your current and prospective donors may have access to at least the last three years of your organization’s 990s. Using the Form 990, donors can learn about your organization’s governance (or lack thereof), operations and programs.

Nonprofits who fail to give the proper attention to the preparation and review of their Form 990 might be unconsciously sabotaging their organization’s reputation with donors.

Here are just a few of the mistakes nonprofits commonly make on their Form 990 that can jeopardize their fundraising efforts.

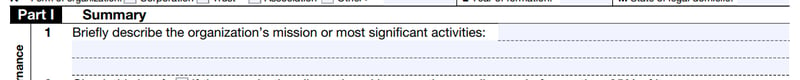

You Don’t Clearly Articulate Your Mission and Program Accomplishments

The mission statement and program accomplishments section of the 990 is located on the first page of the form. Use this section as an opportunity to excite potential donors with key insights about your organization's mission and value to the community, and the work you’re doing.

If your mission and program service accomplishments are vague or inarticulate, donors may not understand your nonprofit’s goals and programs, which could make a donor less likely to give to your organization. When reporting on your program accomplishments, use the section as a chance to tell donors about the great work your nonprofit is doing and the positive impact on your community. Aim to provide specific objectives and measurements for the top three services and report on the accomplishments for the year you’re reporting on.

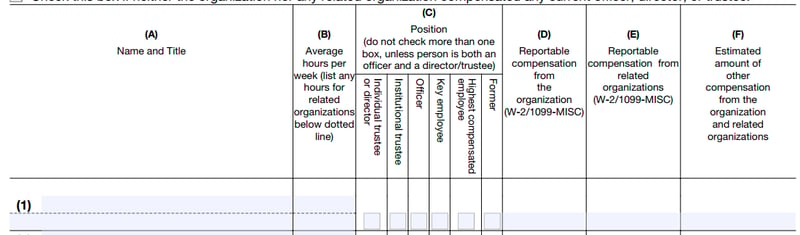

Your Nonprofit’s Executives Are Receiving Excessive (and Questionable) Compensation

Nonprofits must report if any of their executives receive excessive compensation in Form 990. As a result, donors can review the amount of an individual’s compensation as well as the process used to determine the executive’s compensation.

Excessive compensation can become a red flag for donors if the level of compensation seems excessive compared to other similar-sized nonprofits. It falls to your board of directors to ensure the compensation of your nonprofit’s executives is fair and reasonable. Your board should approve compensation arrangements for all officers, directors, trustees and key employees in advance and use comparability data to inform their decision.

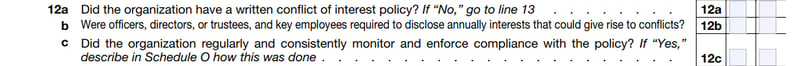

You Don’t Have a Conflict of Interest Policy

A conflict of interest policy encourages greater transparency and is perhaps one of the most important policies a nonprofit board can adopt. Donors will often review an organization’s Form 990 to identify:

- Whether your organization has a conflict of interest policy in place

- If there is a conflict of interest policy in place, whether your organization’s policy requires board members and senior management to annually disclose any real or potential conflicts

- The process your nonprofit uses to manage any conflicts

You Don’t Demonstrate That Oversight Is a Priority for Your Organization

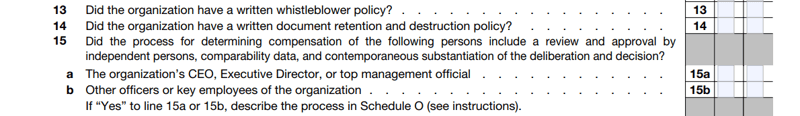

Your Form 990 contains a section on governance and your nonprofit’s policies, which can help demonstrate your organization’s commitment to strong oversight. A donor may evaluate the size of the governing board as well as how many board members are independent. Donors may also look to see if the organization has whistle blower and document retention policies as well as whether your board or designated committee reviews your Form 990 prior to filing.

It's worth noting that in the event of a tax controversy with the IRS, such as an IRS examination, your nonprofit will be penalized for not having these policies in place.

Your Overall Budget Could Use Some Trimming

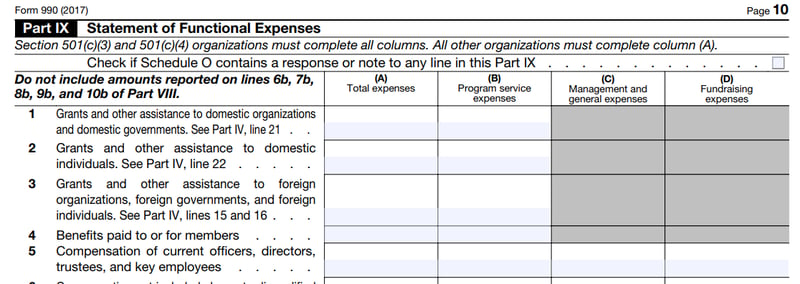

The breakdown of expenses — whether they are management and general expenses or fundraising expenses — in your nonprofit’s overall budget can come under scrutiny by donors. The trouble is that every donor will perceive your expenses in different ways.

Some donors might think management and general expenses indicate inefficiency, while others might see those same expenses as necessary for a nonprofit to have strong internal controls and well-managed risks. If you haven’t already, it’s important for your nonprofit to develop a policy that accurately allocates expenses between program, management and general, and fundraising areas while being as transparent as possible in how the costs are allocated.

Need Help?

Contact us online or call 800.899.4623.